Zivanai Dhewa

Scores of people and business entities have applauded the Government for the introduction of Statutory Instrument 127 (SI 127), saying it will help restore sanity to the economic sector.

Without wasting much time, as soon as Government announced the SI 127, OK-Zimbabwe began to regularise its systems in compliance with the Reserve Bank of Zimbabwe’s directive.

In a memorandum directed to all its Branches across the country, OK-Zimbabwe notified that until its systems are regularised it will cease to accept US$ payments at their tills.

“This memorandum serves to inform all Branches that as a result of SI 127 of 2021, they no longer accept foreign currency as a payment option at their tills effective immediately. Our receipts at the tills are not yet in compliance with the SI which states that inter alia a seller of goods or services is not allowed to issue a buyer thereof a receipt in ZW$ for payment received in foreign currency, or to record sales other than in the currency in which the sale was conducted,” read the memo.

Meanwhile the Reserve Bank of Zimbabwe has given a two week ultimatum for business to regularise its systems.

Posting on its Twitter Handle, the RBZ said, “Business have been given 2 weeks to regularise their systems so that they can comply with the SI on the receipting of goods and services in either foreign currency or local currency. The SI is an essential means of enforcing compliance which is necessary for continued stability.”

The RBZ explained that the implementation of SI 127 was not designed to harm business but to provide a level playing field for business to protect consumers, stating that the use of foreign currency for the payment of goods and services is still allowed as per SI 85 of 2020.

Netizen Godfrey Shumba posted on his Twitter handle applauding Government for SI 127.

“Whatever has been done is a very noble idea; there were a lot of thieves in the retail sector. Today I was shocked to suddenly find my garage selling petrol in RTGS, well done Government,” Shumba said.

This publication managed to speak to one David Chokupa, an economic analyst who greed that there was lack of transparency by some companies that accessed foreign currency at the Auction system and those that received tender for goods sold in foreign currency.

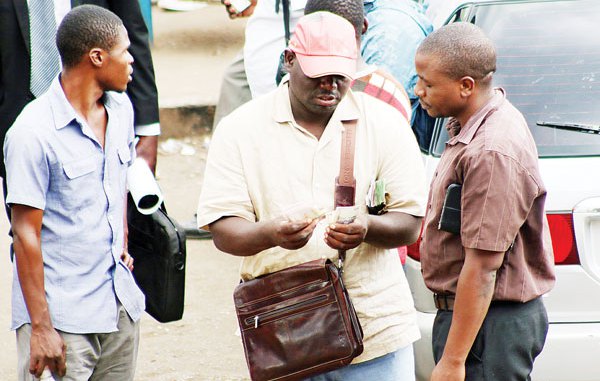

“It is clear that some of the forex accessed through the Foreign Exchange Auction, were not being used for the intended business but were being diverted to the black market. This is the loop that RBZ wants to close.

“Again goods and services tendered in foreign currency and yet being receipted in local currency leaves a gap for that foreign currency to find its way into the black market as it might not be declared to the Reserve Bank.

“What Government has done with SI 127 is not new and unique to Zimbabwe, many countries use that system in order to tame the black market. If Zimbabwe is to achieve Vision 2030 of an Upper Middle Income Economy, then every foreign currency leak should be mended,” said Chokupa.